How To Create A Household Budget In Excel

Whether you manage the finances at your work or at home, having a budget in place is an essential first step. A budget is necessary to learn where you're currently spending, decide where you can save, and determine where you would like to be applying your money.

While the idea of creating a budget can be daunting, using a budget template can help make the process a little less intimidating. With so many templates out there, how will you determine which is right for your specific needs? We've researched the best templates in Excel, and provided them here for you to pick the one or ones that work best for you.

Additionally, we've provided customizable budget templates in Smartsheet, a work execution platform that empowers you to better manage your financial planning with real-time collaboration and process automation.

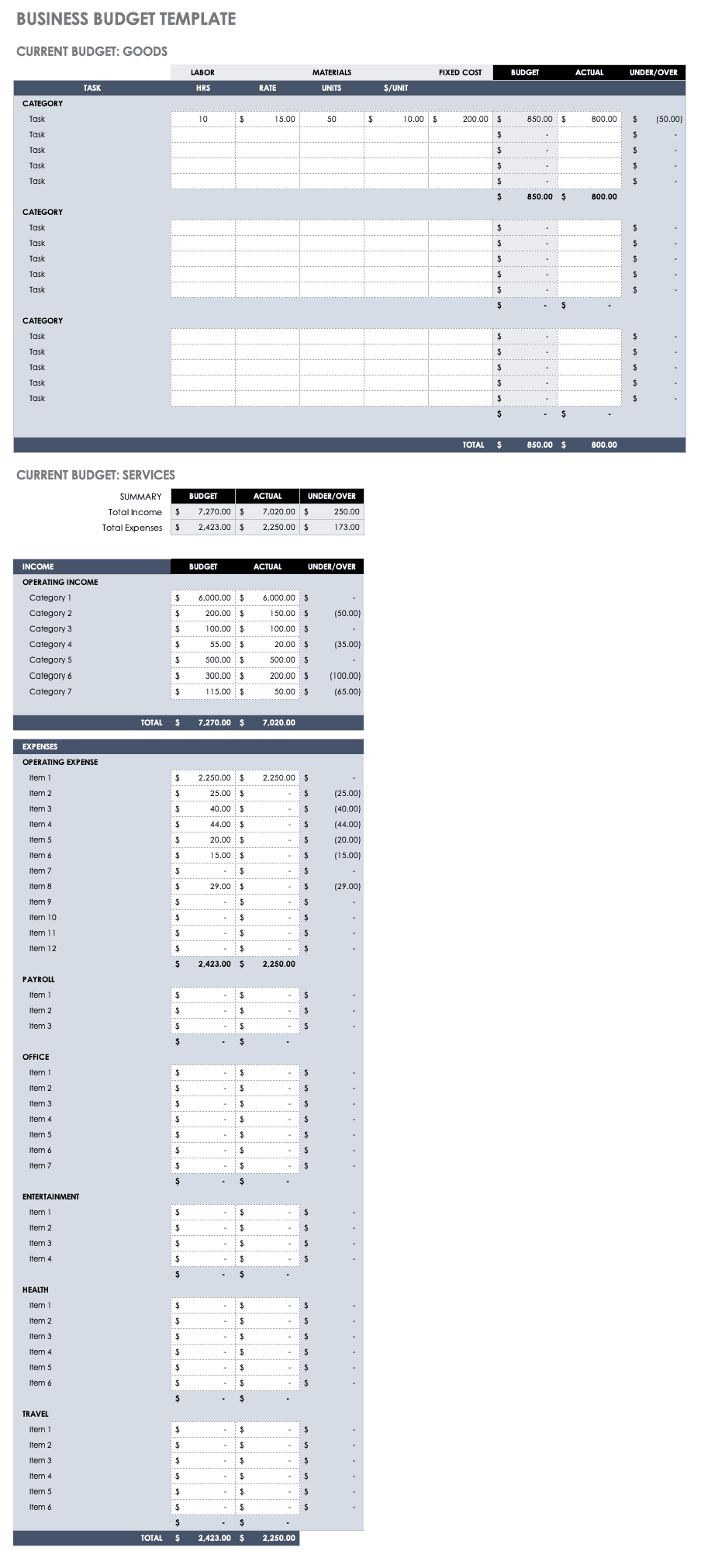

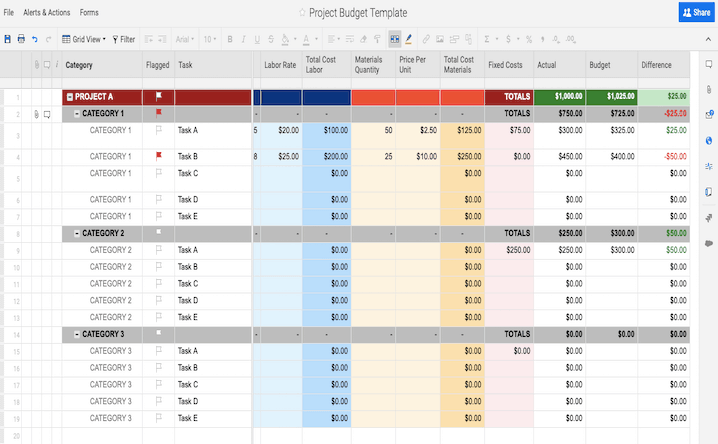

Business Budget

Download Excel Template

No matter the size of your business, having a business budget in place is essential to the growth of your company. The business budget will help you make strategic decisions about where you can grow, where you may need to cutback, and the general health of your company. This business budget template is great for both service providers or companies who make and sell goods.

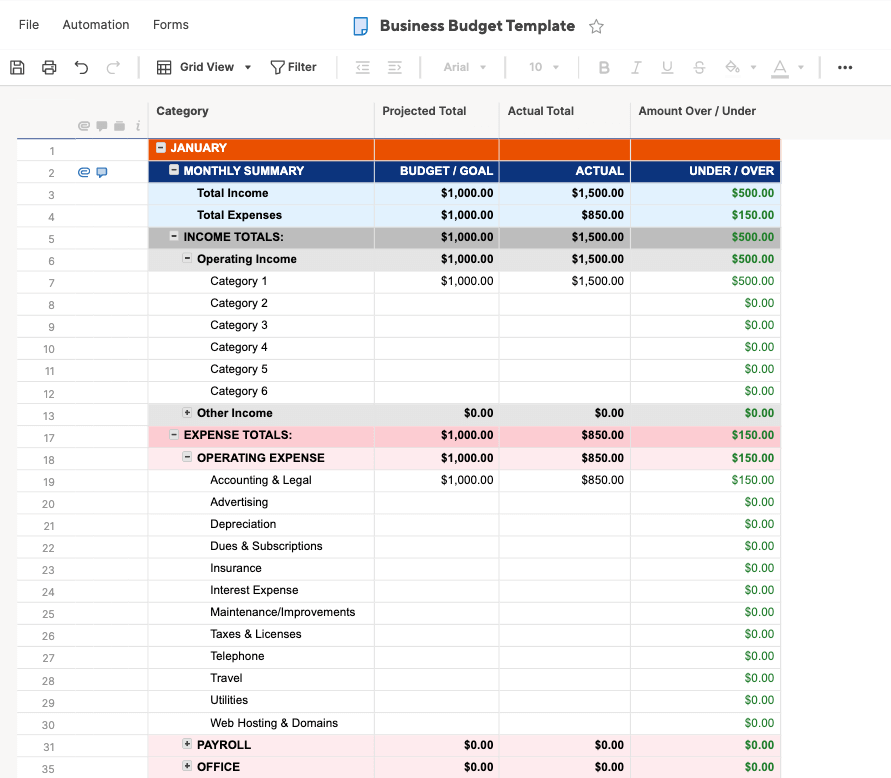

Try Smartsheet Template

Manage budgets related to your business with this real-time business budget template in Smartsheet. Track income against expenses to ensure no item goes unseen and that all savings, spending, and debt repayment goals are achieved. Set automatic alerts when budgets run over the projected amount, and roll up key details into reports and dashboards to share with stakeholders in order to increase transparency and enhance accountability.

See how Smartsheet can help you be more effective

Watch the demo to see how you can more effectively manage your team, projects, and processes with real-time work management in Smartsheet.

Watch a free demo

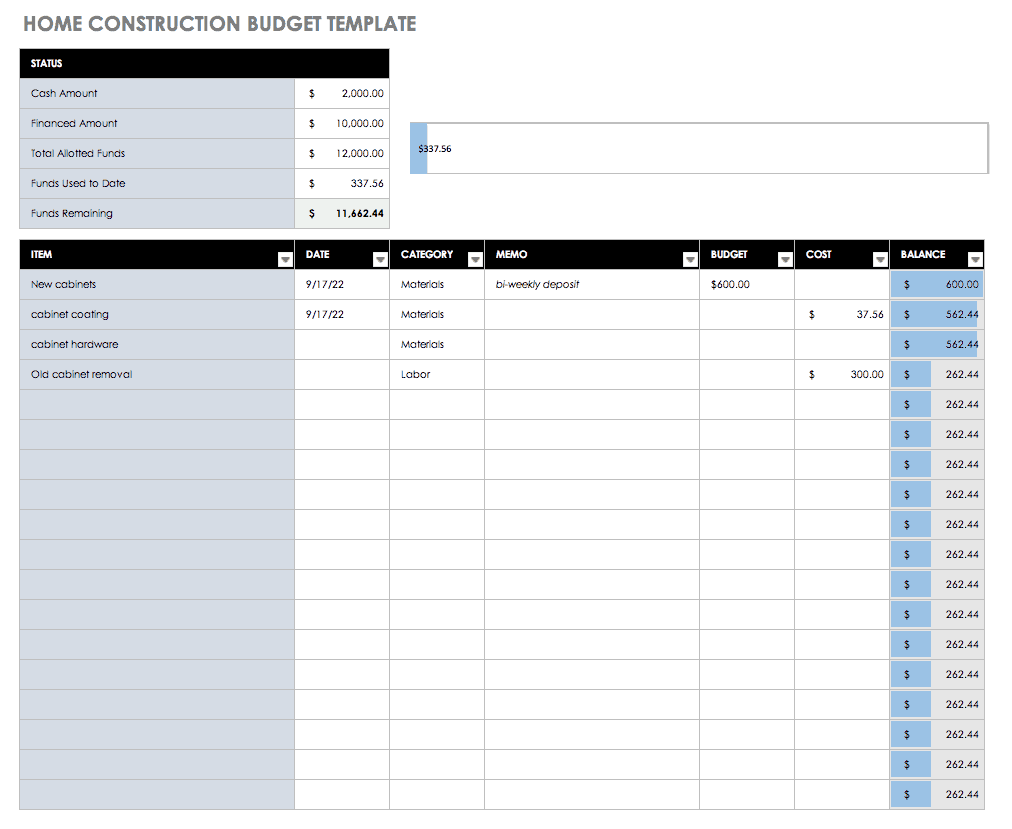

Home Construction Budget

Download Excel Template

Try Smartsheet Template

Whether you're planning to build a house, or simply update your current home, a home construction budget is important to plan for necessary expenses, planned improvements and unexpected emergency repairs. Keep your home construction or remodel on track and on budget with a home construction budget template. Track materials and labor for each individual item against budget, while monitoring a running total of the budget balance remaining.

Personal Budget

Download Excel Template

Try Smartsheet Template

A personal budget is important to help you track and manage your personal income, expenses and savings, and work toward your personal financial goals. Whether this is the first time you've made a budget, or it's time to update your current one, using a personal budget template will help you to quickly gain visibility into your finances. In this personal budget template, you can input your income, savings goals and expenses on one sheet and see a dashboard with your high-level budget numbers on a second sheet.

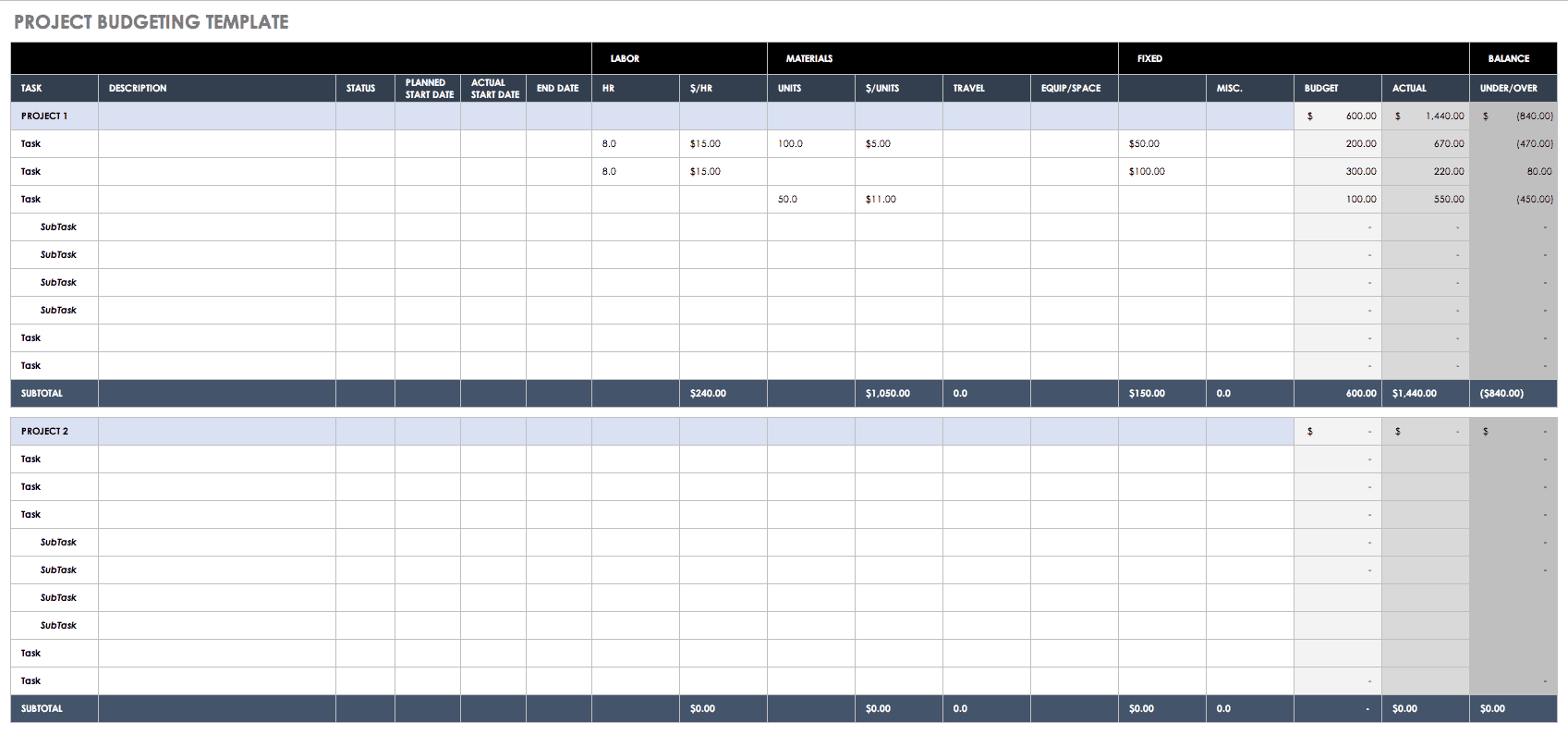

Project Budget

Download Excel Template

An essential factor of managing successful projects is creating and tracking an accurate project budget. This can be a difficult task as project scopes and timelines are constantly changing. Using a project budget template will help you stay on top of your project budget. With this template you can track the material, labor, and fixed costs associated with each project task, and monitor the variance between your actual and budgeted amounts.

Try Smartsheet Template

Manage budgets specific to individual projects with this project budget template in Smartsheet. View and track project-specific details and share with team members and stakeholders to increase visibility into status. Calculate variance and totals for each budget item to ensure that project spend is on track, and set automatic notifications to receive alerts when budget and actual spend don't align.

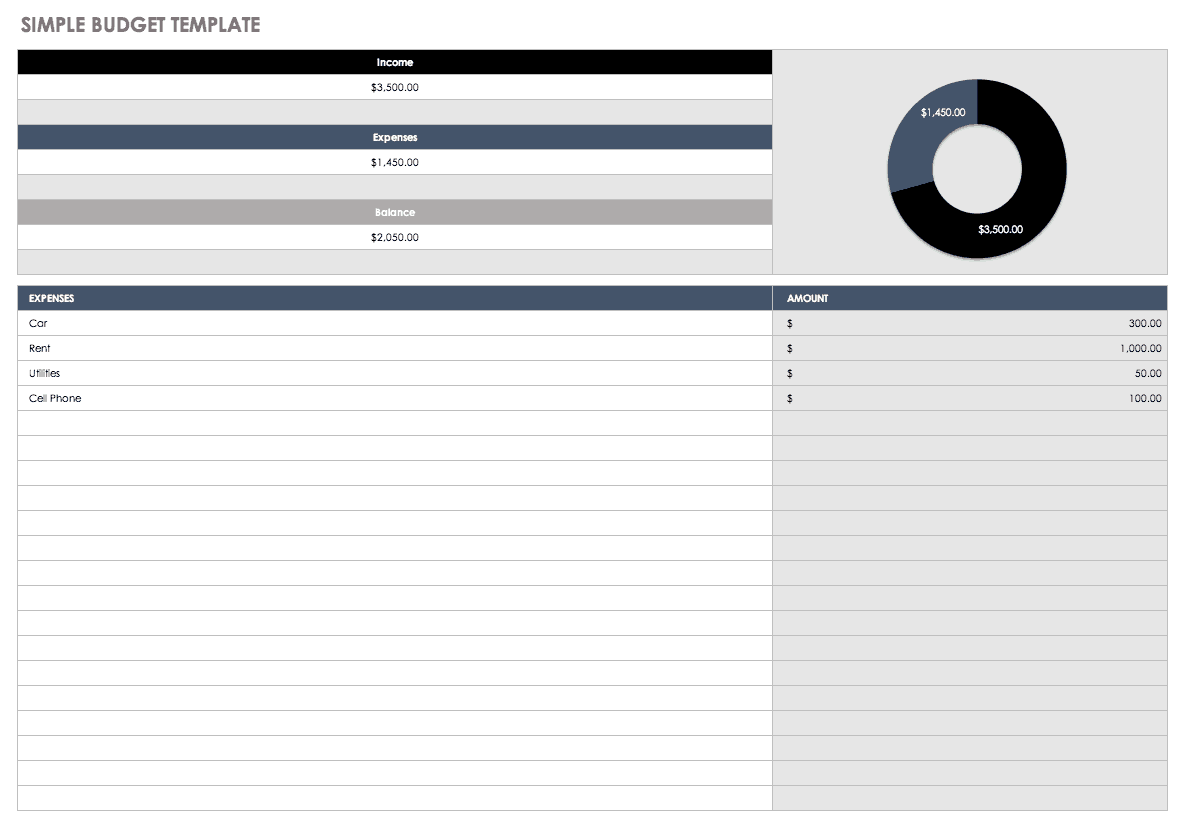

Simple Budget

Download Excel Template

Try Smartsheet Template

If you are looking to create your first budget, the simple budget template will help you get started. This template provides a place for you to list your income and expenses and see totals for each category. Additionally, the included dashboard provides a visual of the portion of income going to expenses and remaining.

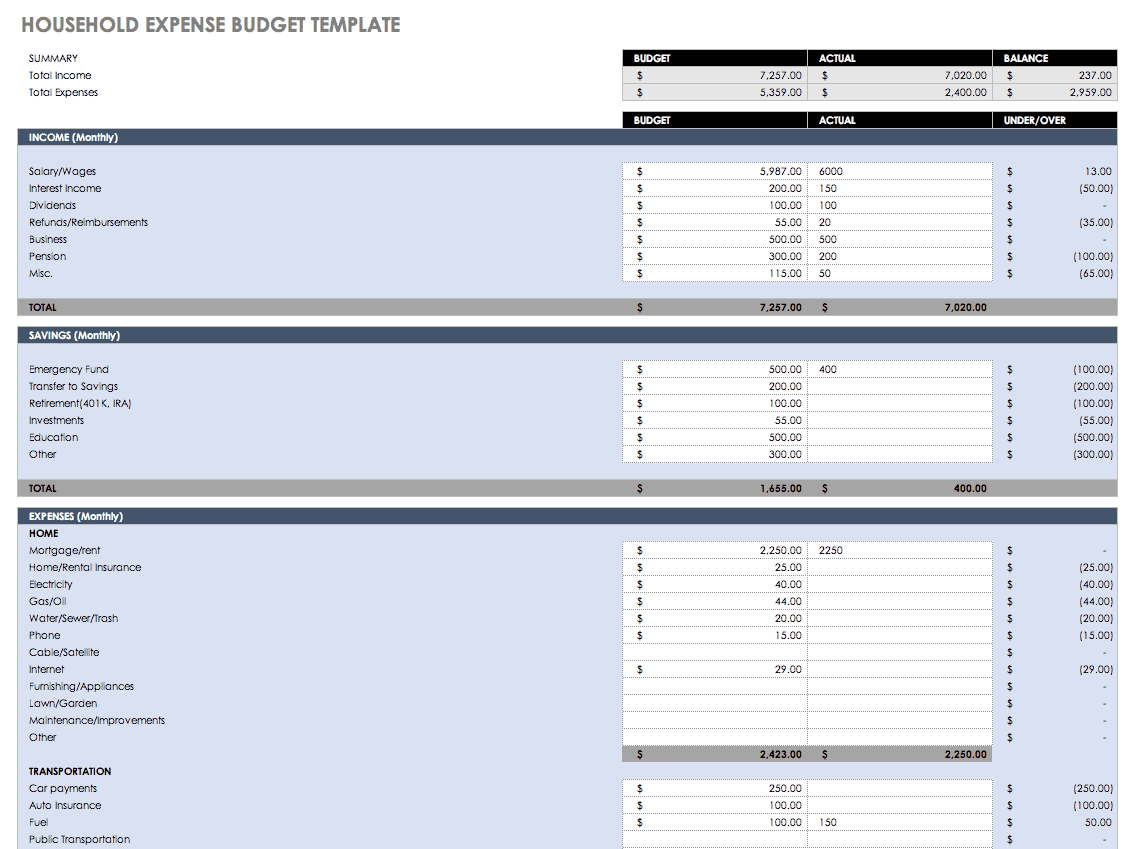

Household Expense Budget

Download Excel Template

Try Smartsheet Template

Similar to the family budget planner, the household expense budget helps track income and expenses for your entire household. The difference is that each sheet in the household expense budget is for a single month, rather than having the entire year on one sheet like the family budget planner. This household expense budget template is helpful to provide a more focused view of each month.

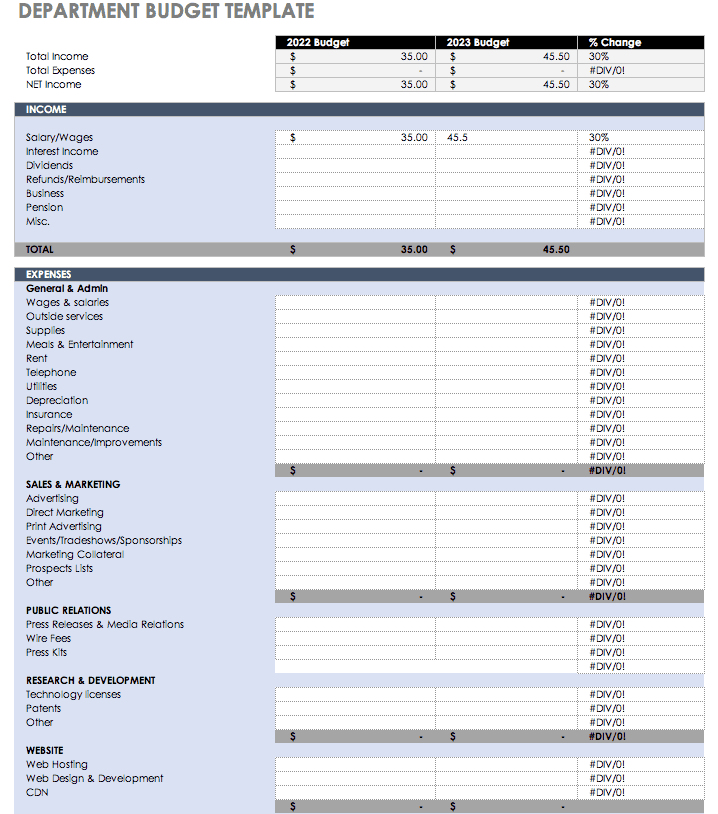

Department Budget

Download Department Budget Template

A department budget is helpful for projecting department expenses for the upcoming fiscal year. This department budget template will help you to compare year-over-year budget numbers by percentage change.

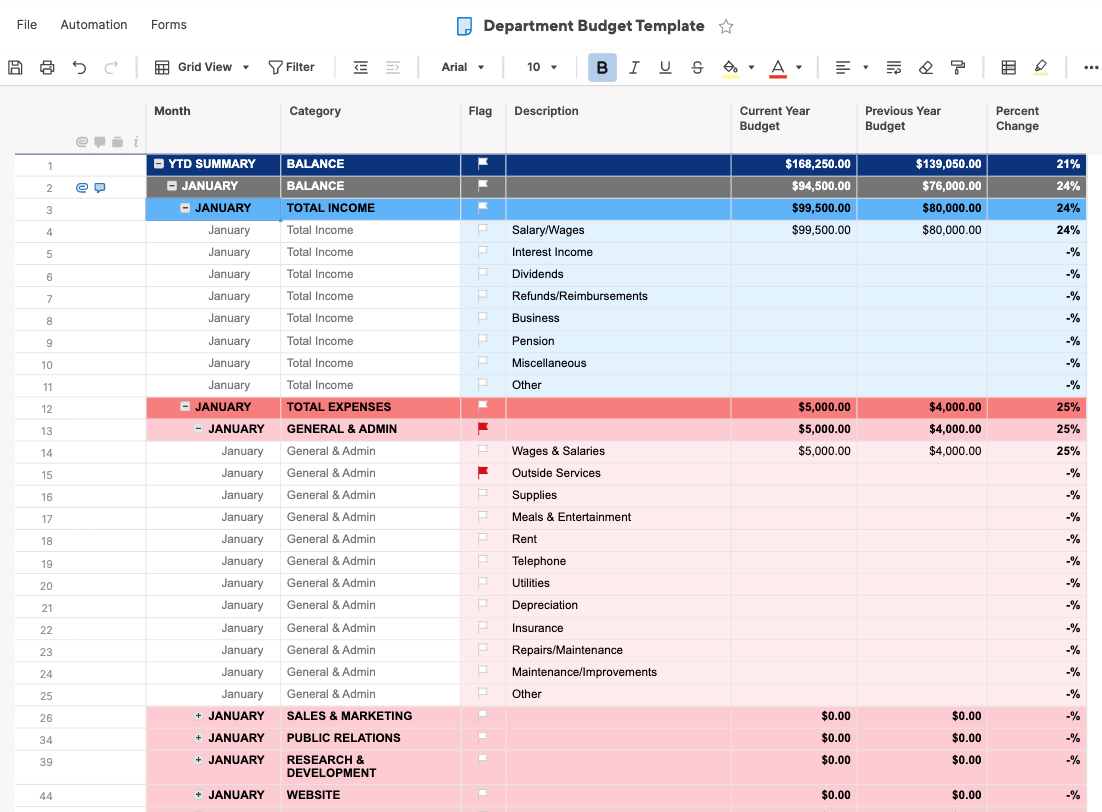

Try Smartsheet Template

Track and report on the budgets of specific departments with this department budget template in Smartsheet. To stay on top of the details, track and manage budget status in real time, organize budgets by department with hierarchies, and assign departmental budget items to individual team members in order to increase accountability and improve transparency across your organization. Compare yearly budget, actuals, and percentage variance in real-time, and set automatic alerts to update you when items come in over the expected values.

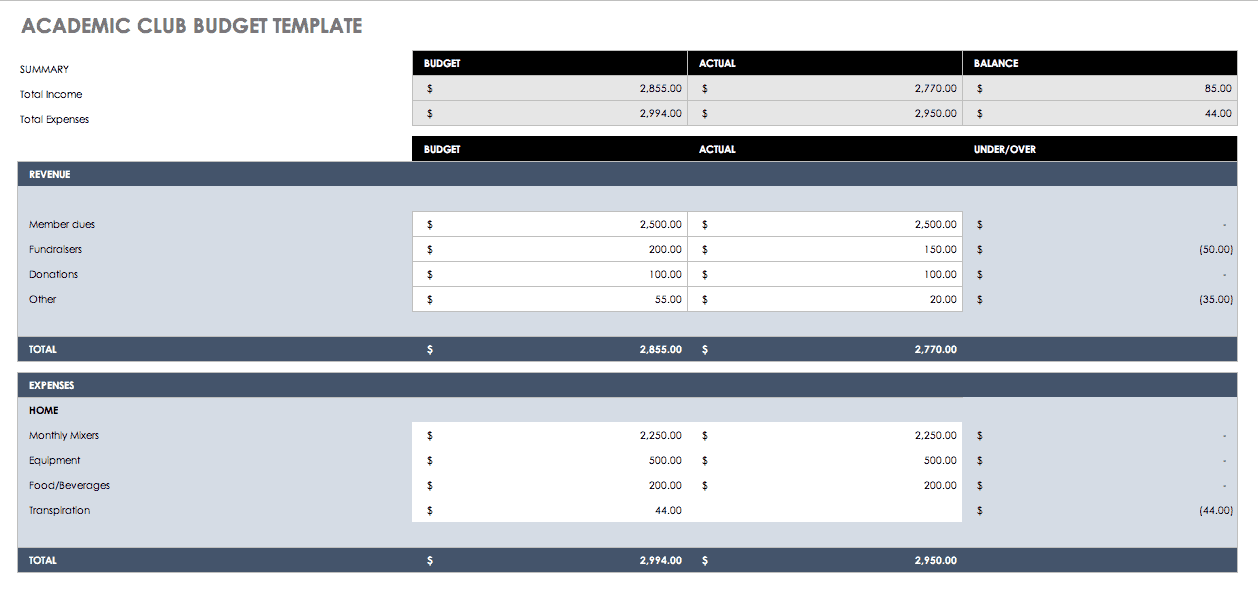

Academic Club Budget

Download Academic Club Budget

Typically academic clubs need to conduct fundraising or obtain sponsorships in order to achieve their yearly objectives. Having an academic club budget in place is important to help manage the operations and strategies of the club, and achieve annual goals. This academic club budget template will help you quickly track and manage club revenue and expenses, and get a quick look at budget versus actual balances.

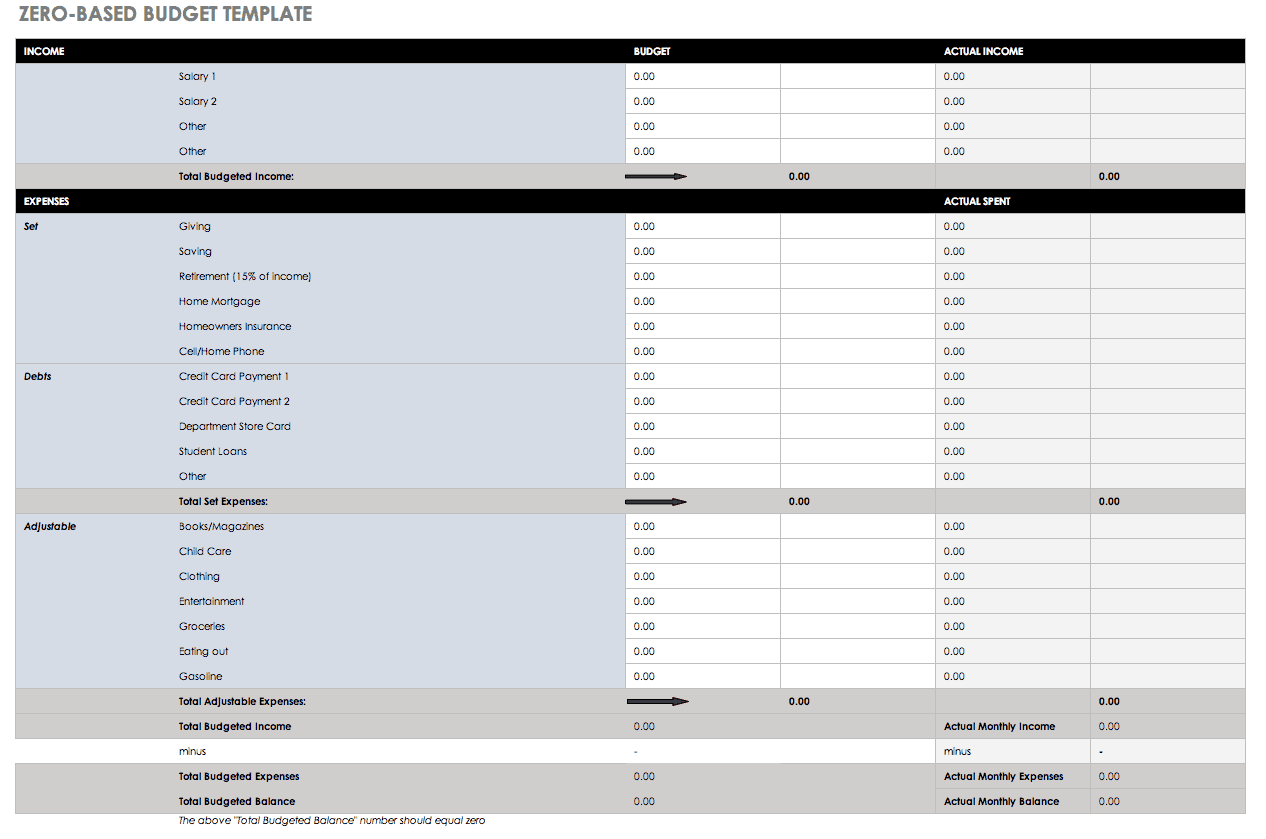

Zero-Based Budget Spreadsheet

Download Zero-Based Budget Template

A zero-based budget template is a monthly budget where the difference between your monthly income and expenses should equal zero. The concept behind this budgeting method is that you allocate every single dollar of your income to some area of your budget, so that you know exactly where your money is going. This template includes two sections: on one side you will list all of your income for the month, while the other side is for your outgoing expenses. Once each side is complete, you will be able to see whether the difference in your income and outgo is zero and, if not, adjust accordingly.

Wedding Budget Planner

Download Wedding Budget Template

Planning your wedding day can take a lot of time, effort, and money. That's why having a budget in place, prior to starting your planning, is important to give you a baseline on how much you would like to spend. Using a wedding budget template is helpful not only to determine how much money you will need to save, but also to surface expenses you had not yet thought of. In this wedding budget template, you'll find a wedding budget estimator to input the amount you would like to spend on each item. Then as you begin the planning process, you can add the actual spent amounts to track the variance to budget.

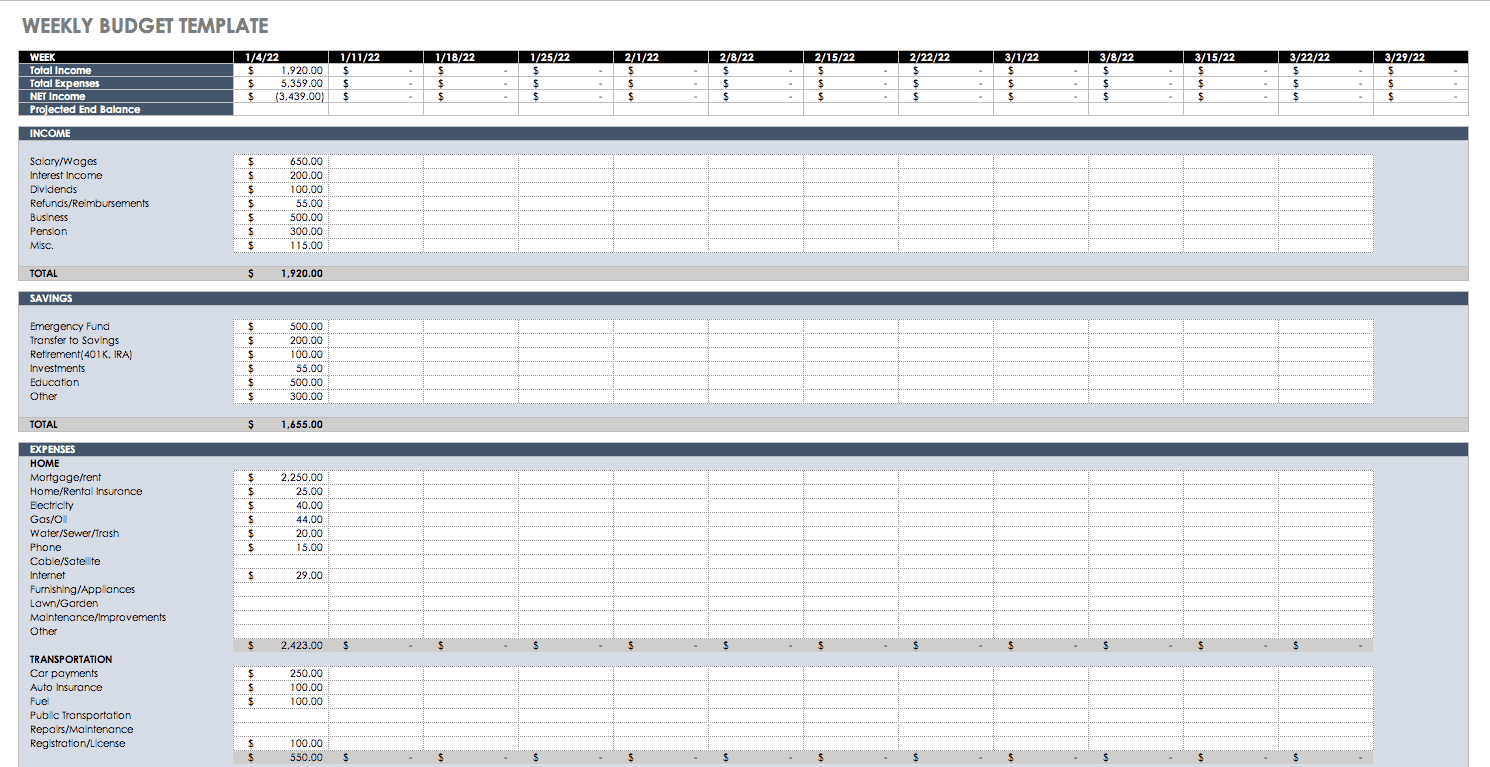

Weekly Budget Planner

Download Weekly Budget Planner Template

A weekly budget planner template is helpful to track your income and expenses on a weekly or bi-weekly basis. Based on the family budget template, this budget planner simply includes additional columns for each week to have a more focused view of your budget.

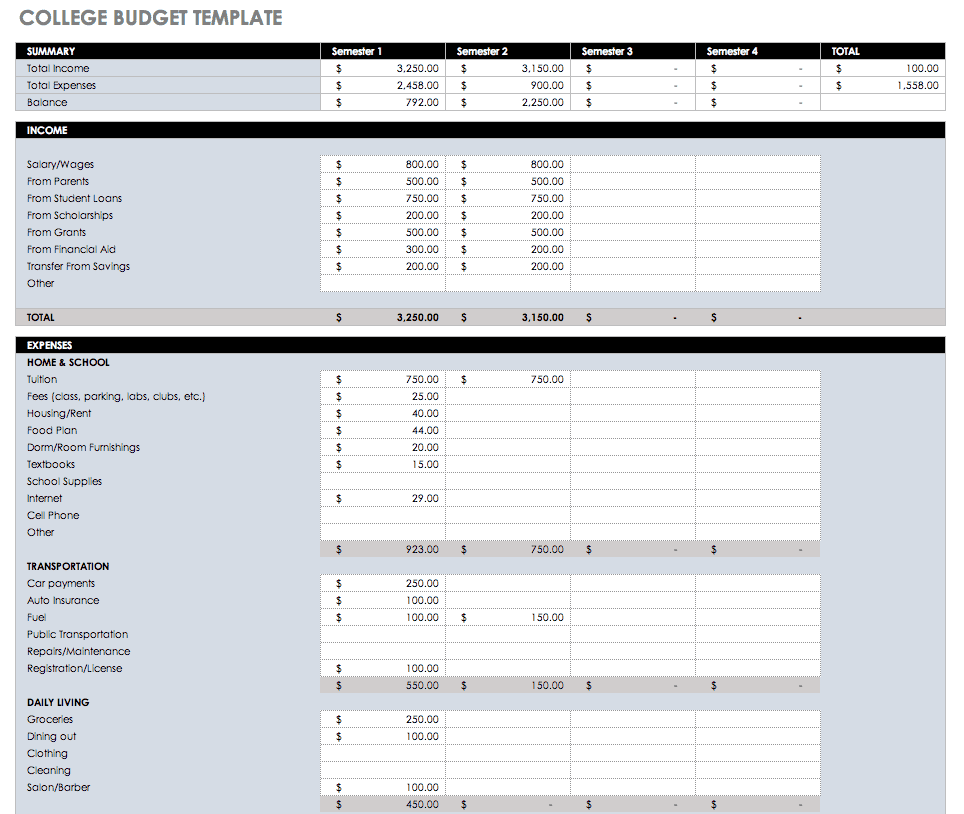

College Student Budget

Download College Student Budget Template

For anyone headed to college, it's important to prepare a college student budget as early as possible. Although the amount of money needed to attend college can be overwhelming, a college student budget template will help to determine how much money will be needed for expenses, where to save money and how to make it all work. In this college student budget template, you will find a sheet to include all income and expenses on a quarterly basis, and a second sheet to estimate monthly college expenses.

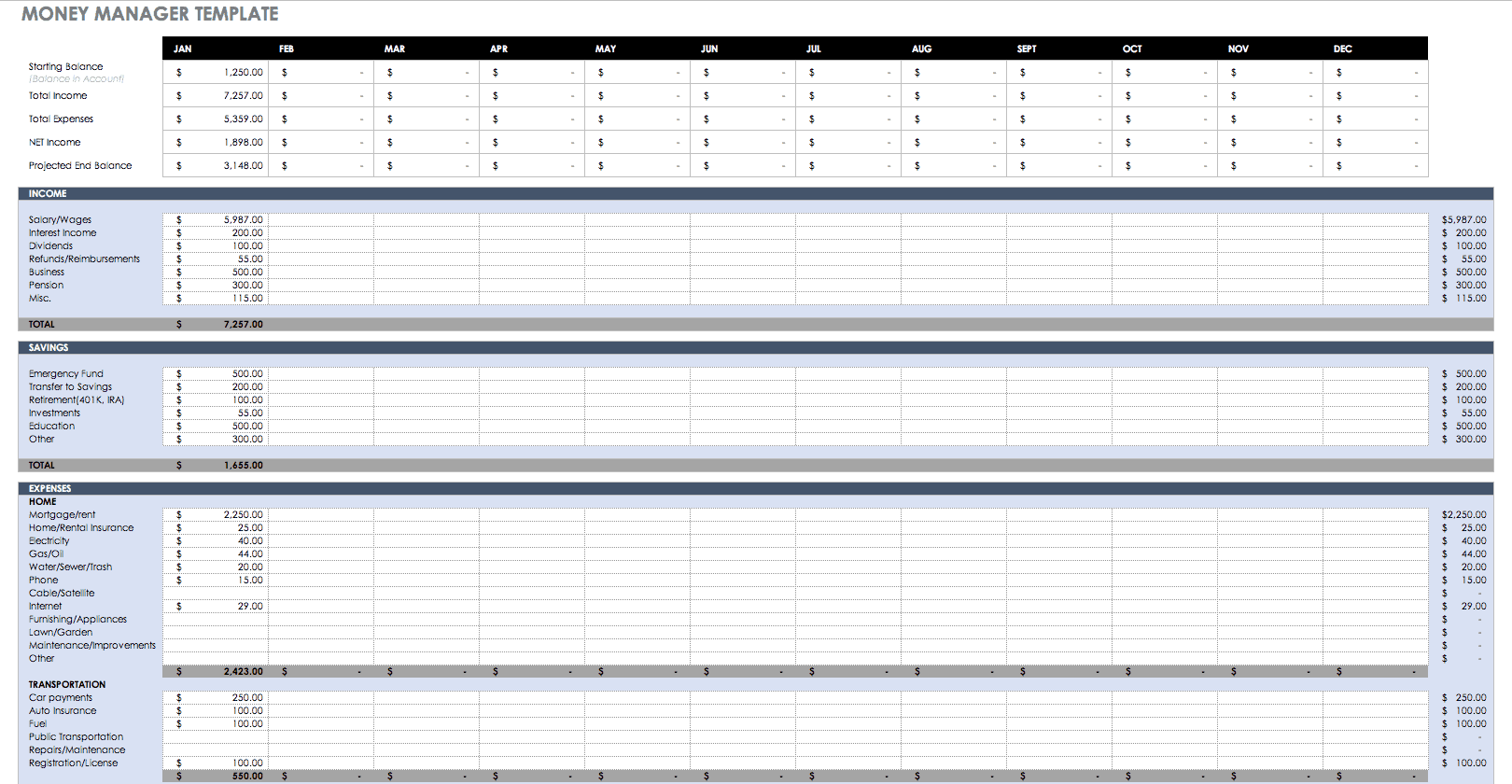

Money Manager

Download Money Manager Template

With a money manager template you can track expenses and manage your budget in one location. Made up of a yearly budget, a monthly budget report and a transaction history log, this money manager template was meant to be a comprehensive budgeting solution. In this template you can record transaction, track monthly and yearly spending, and even balance your checkbook.

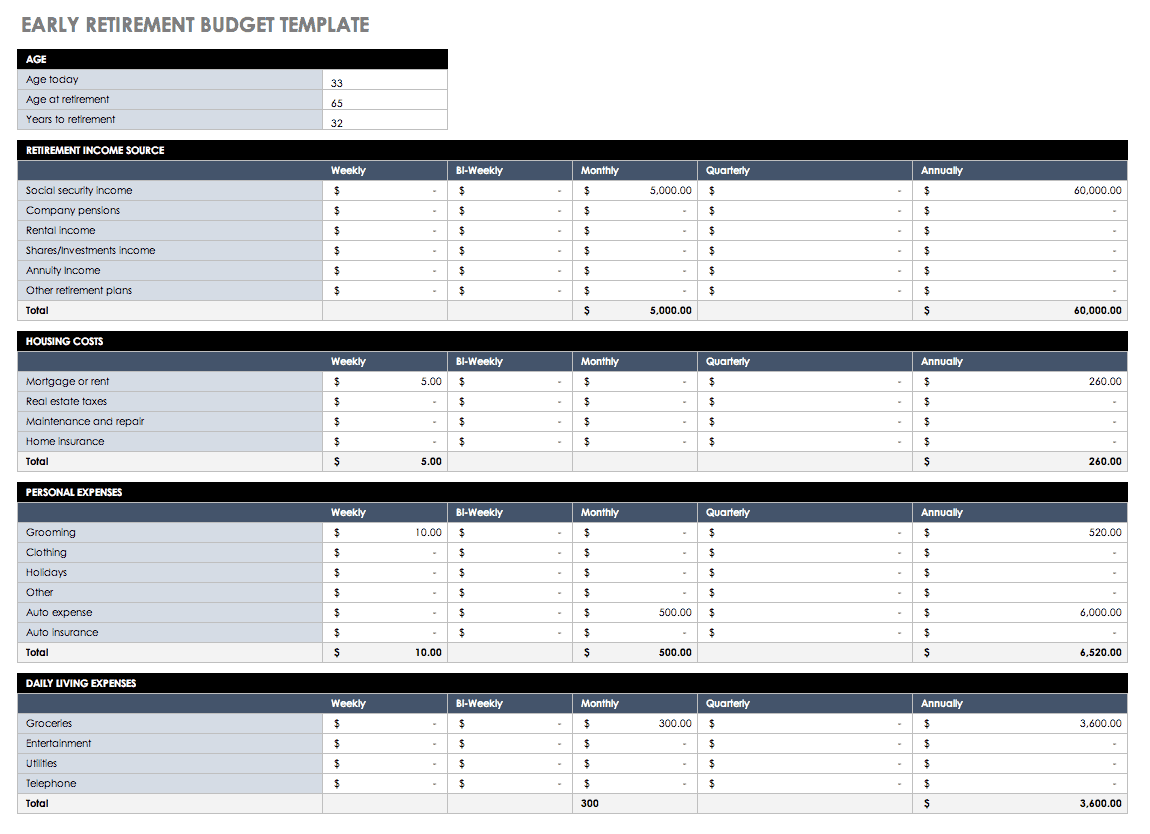

Early Retirement Budget Sheet

Download Retirement Budget Template

When considering your retirement, it's important to create a plan early on. Do you know how much your retirement daily needs will add up to? Or where the income will come from? Using an early retirement budget template will help to determine exactly how much you should save to be comfortable in retirement. This template includes two sheets: one to estimate your retirement income and expenses on a weekly, bi-weekly, monthly, quarterly and annual basis, and the second to look at your estimated budget with inflation factored in.

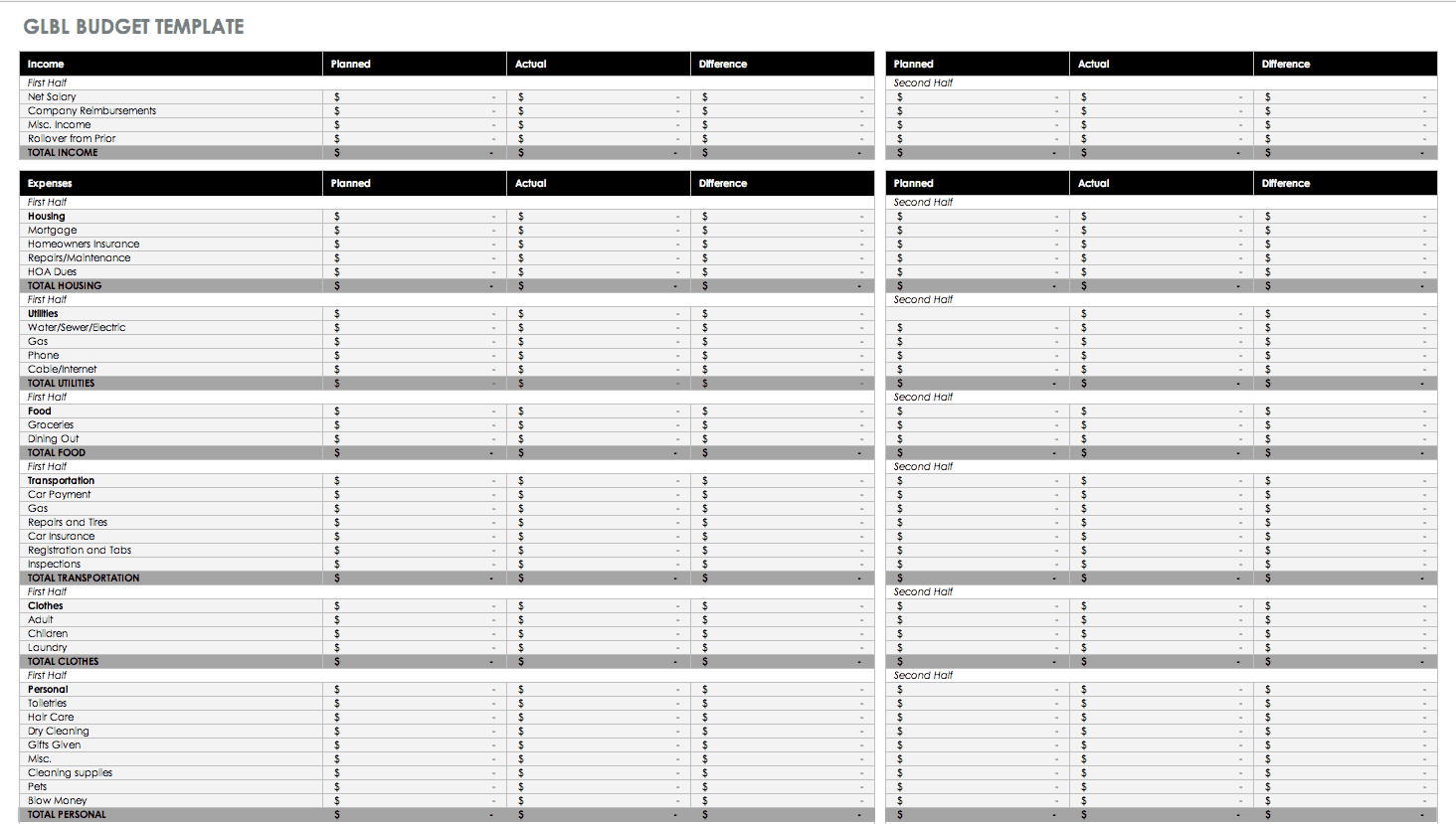

GLBL Budget Spreadsheet

Download GLBL Budget Template

A GLBL budget template is similar to the zero-based budget, because it follows the same budgeting method of allocating every dollar of income toward an outgo, resulting in a zero balance. However, the difference with the GLBL is that it helps manage your budget per paycheck rather than monthly. This helps reduce the possibility of overspending in one pay period, which would make you short in the next. In this GLBL budget template you will input all your incoming and outgoing money on the first sheet, and track transactions on the following sheets.

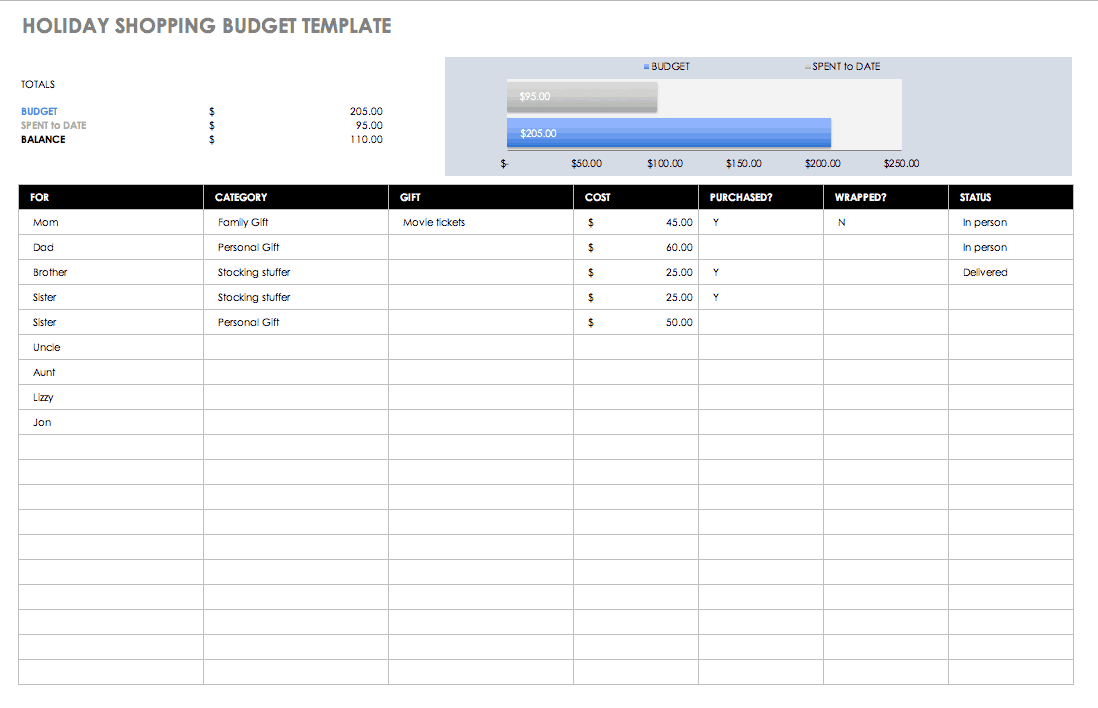

Holiday Shopping Budget

Download Holiday Shopping Budget Template

The holidays can be a hectic time for both your calendar and your pocketbook. To ensure you don't forget to purchase that special gift for grandma, complete your holiday shopping budget before the rush begins. Use this holiday shopping budget template to list the gifts that you would like to purchase, for whom, how much each will cost, if it's wrapped and whether you will ship or hand-deliver each. Within this template, you will also find a handy dashboard that provides quick visibility into how much you have left to spend in your holiday shopping budget.

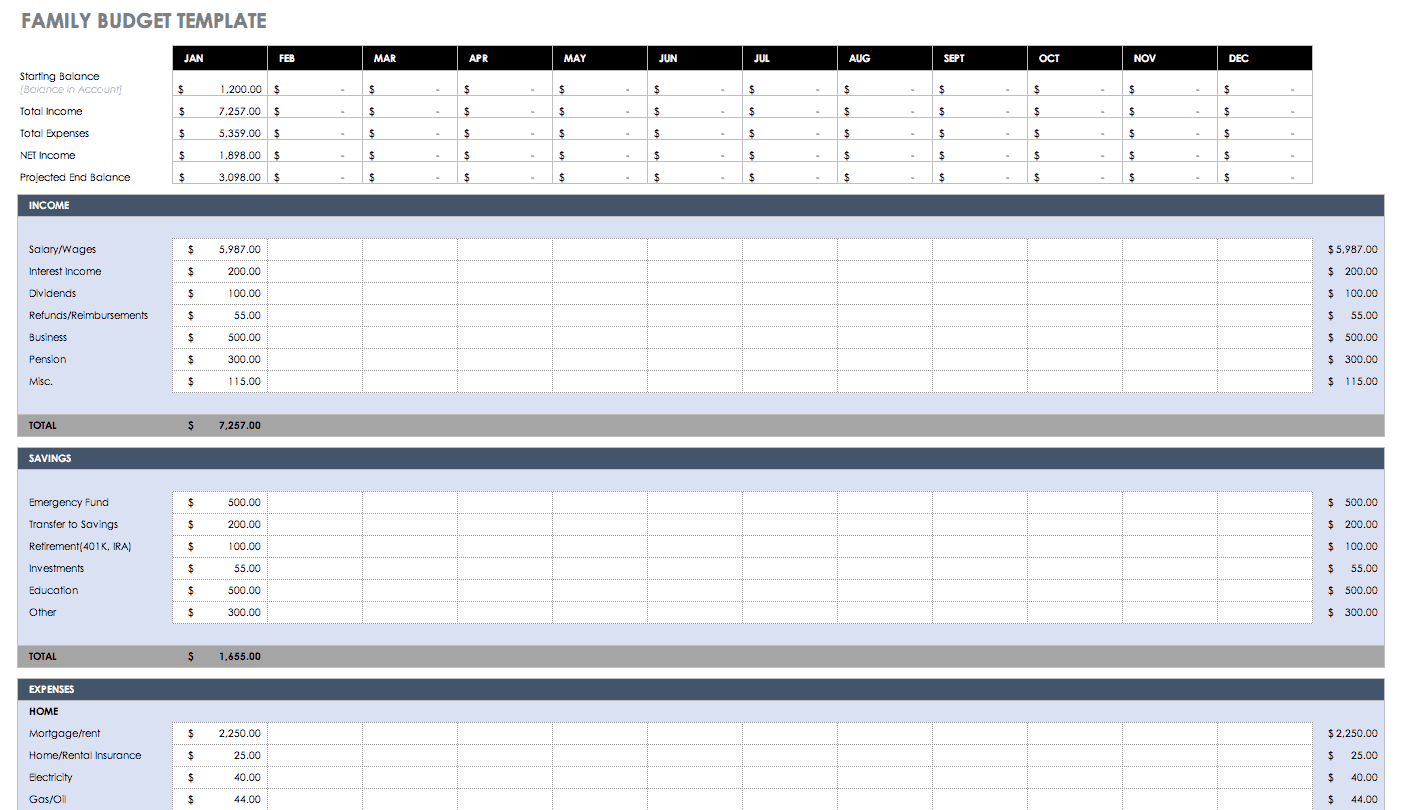

Family Budget Planner

Download Family Budget Template

Families who are serious about their financial future will find value in creating a family budget planner. Whether to save for buying a car or family house or putting kids through college, a family budget planner template will help create your yearly budget for your family to accomplish your goals. This family budget planner template breaks down all family income and expenses on a monthly basis, and provides a roll-up of year to date totals for each category.

Importance of a Personal Budget

Creating a personal budget is not only important for your financial well-being and peace-of-mind, but also for your short and long-term goals. Taking control of your finances with a personal budget template will help you make headway on these goals.

To get started, you want to consider the following steps to help you establish your personal budget:

- Set your goals. Take some time to make a list of your short and long-term goals. Determine why each goal is a priority, how you plan to achieve them, and the timeframe in which you would like to accomplish them. Short-term goals should only take a year to accomplish and would include items like paying off a credit card. Your long-term goals could take many years to accomplish, with examples of long-term goals including saving for your child's education or your own retirement.

- Track your spending. To make accurate estimates of how much you should allocate to each expense within your personal budget, you will need a sense of how much you are currently spending in each area. Review your bank statements for the last three to four months to get an idea of your spending. Of course, you may decide to change the amount you budget for each item, but this will at least provide a baseline to go off of.

- Personalize your budget. Using a personal budget template is helpful to get your budget started, though you can always personalize your budget to match your specific needs. Additionally, just because you create a budget one month, doesn't mean your expenses and goals will be the same for the next. Be sure to have monthly check-ins on your budget and don't hesitate to update it as your circumstances change.

Getting Started With a Personal Budget Template in Excel

Now that you've made a list of your goals and started tracking your expenses, you can begin creating your actual budget using a personal budget template.

Begin by downloading the personal budget template, and inputting your income, savings goals, and expense amounts for the first month. This template is made up of two sheets, one for your budget breakdown and the second is your dashboard.

Within the first sheet, you will find three sections, including income, savings and expenses. The categories of the income section are:

- Salary/Wages

- Interest Income

- Dividends

- Refunds/Reimbursements

- Business

- Pension

- Misc

The next section is where you will input your savings goals. These goals may include both your short-term and long-term savings goals that you listed earlier. This section includes the following categories, but can be changed to fit your goals:

- Emergency Fund

- Transfer to Savings

- Retirement (401K, IRA)

- Investments

- Education

- Other

The last section of the personal budget sheet is for expenses. This section has various primary categories, with multiple sub-categories associated. The primary expense categories include:

- Home

- Transportation

- Daily Living

- Entertainment

- Health

- Vacation/Holiday

Once you have input the individual amounts for each of the income, savings, and expense categories, you will see that the total for each month is calculated at the bottom of each column. Additionally, totals are calculated at the end of each row, representing your year-to-date total for each budget item, category and section.

On the second sheet you will find your budget dashboards. Dashboards are helpful to provide a quick visual into the summary and health of your budget, and will automatically update as you make changes to your personal budget sheet. The dashboard sheet included in this personal budget template has the following four distributions:

- Potential to Save Summary This summary calculates your potential savings, on a monthly basis, after you have met your current savings goals for the expenses incurred. The potential to save amount is calculated by subtracting the Total Savings and Total Expense amounts from Total Income.

- Income to Expenses Chart The bar chart provides a quick look at the difference between your total income and expenses on a monthly basis, which is helpful to provide a high-level view of the health of your budget.

- Income-Expense-Savings Pie This pie chart is helpful to determine the breakdown of your budget, providing a visual of what proportion of your budget goes to income, savings, and expenses.

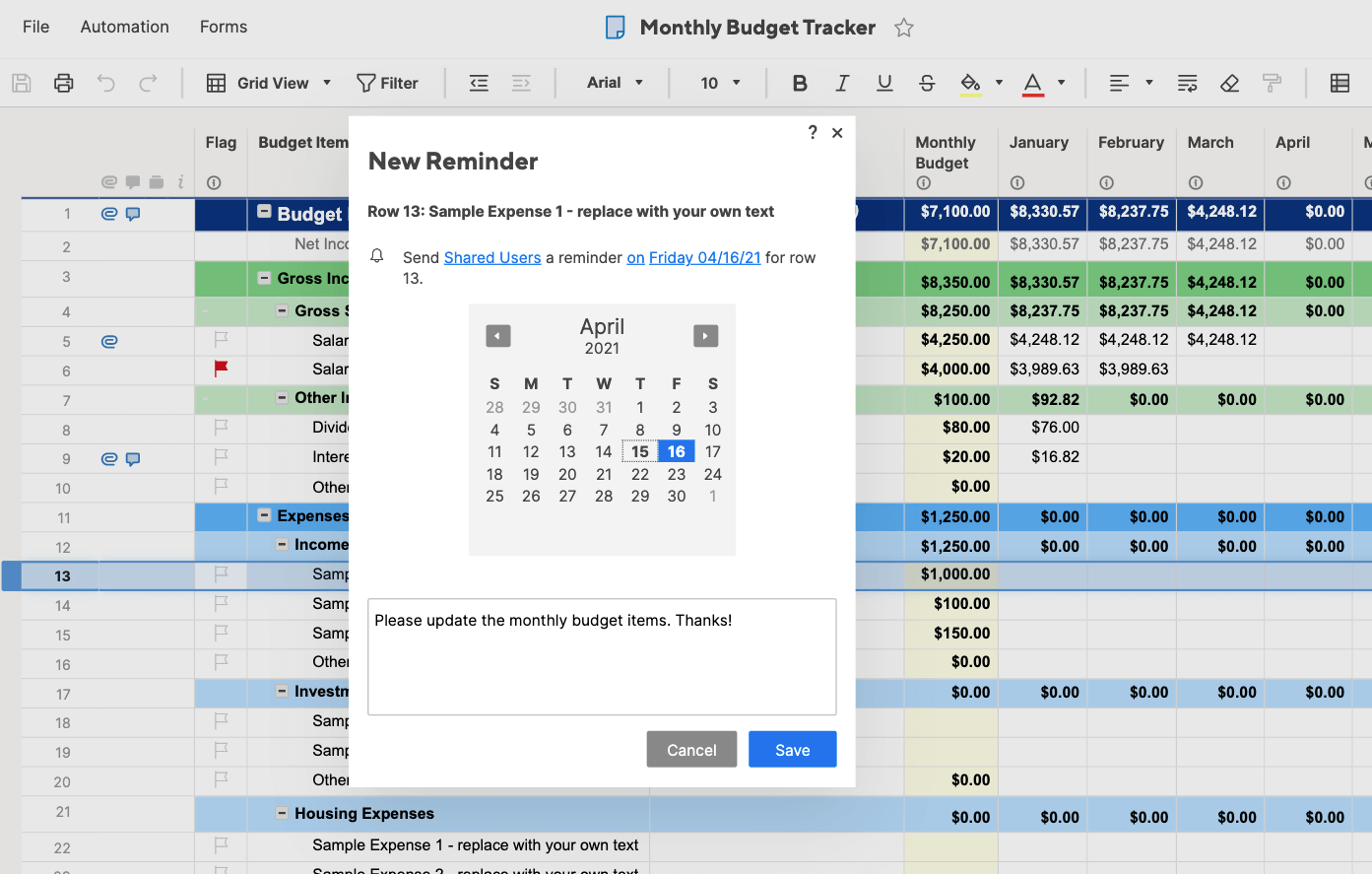

How to Use a Monthly Budget Template in Smartsheet

Smartsheet is a spreadsheet-inspired work management tool with robust collaboration and communication features. Its pre-built monthly budget template makes it even easier to create a budget, conduct monthly check-ins, and improve accountability. In this template, input your monthly budget and then track it against your monthly actual spent. With pre-set formulas in place, you will see your annual total, annual budget, and annual variance automatically calculated as you make changes to budget items. Smartsheet's powerful collaboration features allow you to attach files, set up reminders, and share your budget with key stakeholders.

Here's how to use a monthly budget template in Smartsheet:

1. Select a Personal Budget Template

- Go to Smartsheet.com and login to your account (or start a free 30-day trial)

- From the Home screen, click Create New and choose Browse Templates.

- Type "Budget" in the Search Template box and click the magnifying glass icon.

- You'll see a handful of results, but for this example, click on Monthly Budget Tracker and click on the blue Use Template button in the upper right-hand corner.

- Name your template, choose where to save it, and click the Ok button.

![]()

2. Input Your Budget Information

A pre-made template will open, with sample content filled in for reference and the sections, categories, and subcategories already formatted. With Smartsheet, it's easy to add or delete rows depending on details of your budget.

Simply right-click on a row and select Insert Row Above/Below to add a row or Delete Row to remove a row.

- Update the category and subcategory names under the Budget Item column, to match your specific budget.

*Note that within this template, the Savings section is included under the Expense section. Feel free to move this section by selecting the rows you would like to move, right-click on the rows and select Cut Row. Next, right-click on the row you would like to insert the cut section above and select Paste Row.

- Input your income, savings and expense amounts for each of your budget items under the Monthly Budget Column. You'll notice that the hierarchy is already formatted for you, with formulas included to automatically calculate category totals based on subcategory item amounts.

- On the left side of each row, you can attach files directly to a budget item (perfect for attaching account statements, tax documents, and more).

- Include helpful details within the Comments column, such as account login details or links to specific accounts.

![]()

3. Update Monthly Budget Actuals

- As the month progresses, input the actual dollar amounts for each of your budget items under the current month column. You can set up Reminders to occur on a daily, weekly or monthly basis. To set up Reminders, right-click on the respective row on the sheet and choose Set Reminder. You can also set a reminder by clicking the Automation button above the toolbar. For more information on setting up reminders, click here.

- Share your budget sheet with anyone needing access to budget amounts. This will not only help others stay up to date on budget status, but also increase accountability on your side to stay within budget. To share your budget sheet, click on the Sharing tab at the bottom of the sheet. Add email addresses for those you would like to share to, include a message and click the blue Share button in the lower right-hand corner of the Sheet Sharing box.

Better Manage Organizational Budget and Finance Operations with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there's no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

How To Create A Household Budget In Excel

Source: https://www.smartsheet.com/top-excel-budget-templates

Posted by: mcdonaldjaclut36.blogspot.com

0 Response to "How To Create A Household Budget In Excel"

Post a Comment